Traveling can be all sorts of exciting. Being able to explore a new place, try new foods, and meet all sorts of people, there is a lot we desire to accomplish when we take time off from work to step out of our comfortable routine and oftentimes, money, is the last thing we want to think about. How we choose to spend our money when traveling is very much a personal choice and depends on what type of adventure you are looking for. Yet, how we choose to spend our money can also determine how much we get to travel. Traveling can get expensive, but it can also be extremely cheap if you make smart decisions, and that starts with keeping track of how much you spend. In this post I will share how I keep track of expenses on the road, hopefully allowing you to take more trips by saving a little bit more on your upcoming one.

Tip: One aspect I find quite interesting when traveling is how our concept of money can shift when handling different currencies. Unfortunately, this is where a lot of us can go wrong. Whether it be the conversion from Canadian dollar to Japanese Yen or Euros to Thai Baht, we are not always going to have the ability to pull out our phones and check the conversion rates every time we make a purchase, and this can be the death to our wallets. Especially when the foreign currency rate is higher our minds will often fail to understand how much we are really spending on our purchases. In England, the British pound is a lot higher than the Canadian dollar, so buying a meal for £15 may not sound like a lot but in reality, $25 plus a credit exchange rate (if you are paying with your bank card) can add up. It may not be simple at first but always keep in mind how much it truly costs when making a purchase away from home. In addition, taking out cash at the beginning of your trip can save you from hefty credit exchange transactions. I always take out my cash at an airport ATM’s. ATM’s will often give you a better rate than currency exchange shops (they can sometimes be a rip off).

Next, our routines are vastly unalike from home to vacations. At home we may spend our money similarly every week, but while mobile this can change greatly from one day to the next. An inconsistent routine can make tracking expenses quite a challenge and while there are different ways to keep track, such as saving receipts or looking through credit bills, this is one method I choose to use to remember where my coins are disappearing throughout the day.

Personally, I found the easiest technique to quickly keep track of expenses is to create a notes page on the country I am visiting and the days I am there. Under each date, in the format of a to-do list I will type my purchases right after making them, allowing me to be aware of where and when my cash has gone. At the end of the day or when I can find time again, I will convert the exchange rate and then input these numbers into google sheets where I can easily track the total expense of that destination. For example, the screenshot below showcases my expenses for both Singapore and Malaysia. Most times, I would do one destination at a time but because I only stayed in Singapore for a night I found it easier to combine the two. Under the destination, I would input the amount of cash withdrawn at the start of the trip and continue down with each of my purchases. As I was using both cash and credit I also attempted to keep track of when a purchase was made with my card versus with cash.

The issue I found with keeping receipts or checking past bills is that I’d often forget where and why I spent my money. A restaurant may be listed as an odd name on your bill, so attempting to remember what the reason was for going there can create challenges in tracking expenses and understanding how much you are spending on each category. With this method, I found that even after a few days I can input the information onto Google Sheets without having to stress about what purchase was made.

When I would finally find time I would make sure to transfer the expenses from the notes app onto google sheets. In my screenshot above the initial prices would be typed in the local currency (on the left), but when I would move this information onto Google Sheets I would convert the currency and type it as shown on the right. After I would insert the numbers into Google Sheets I checked it off the list once it was completed.

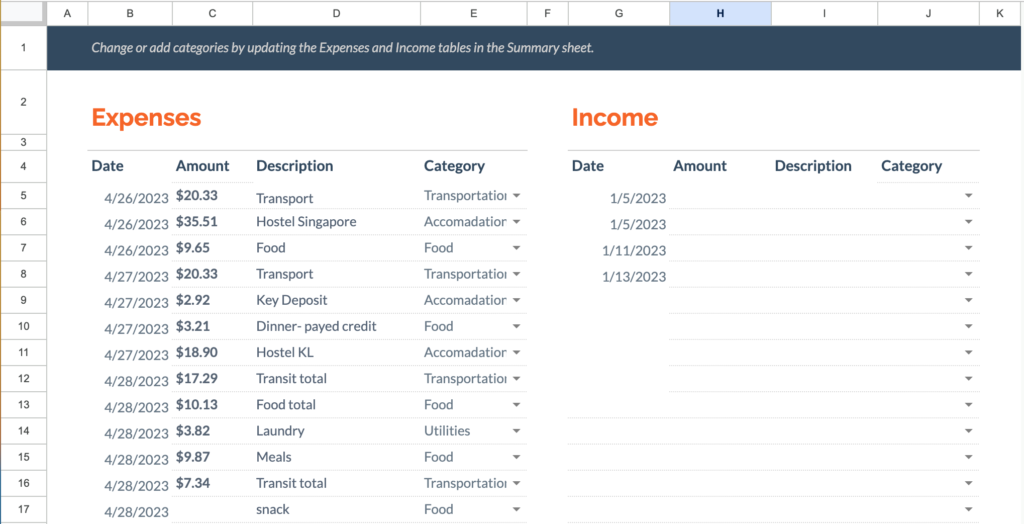

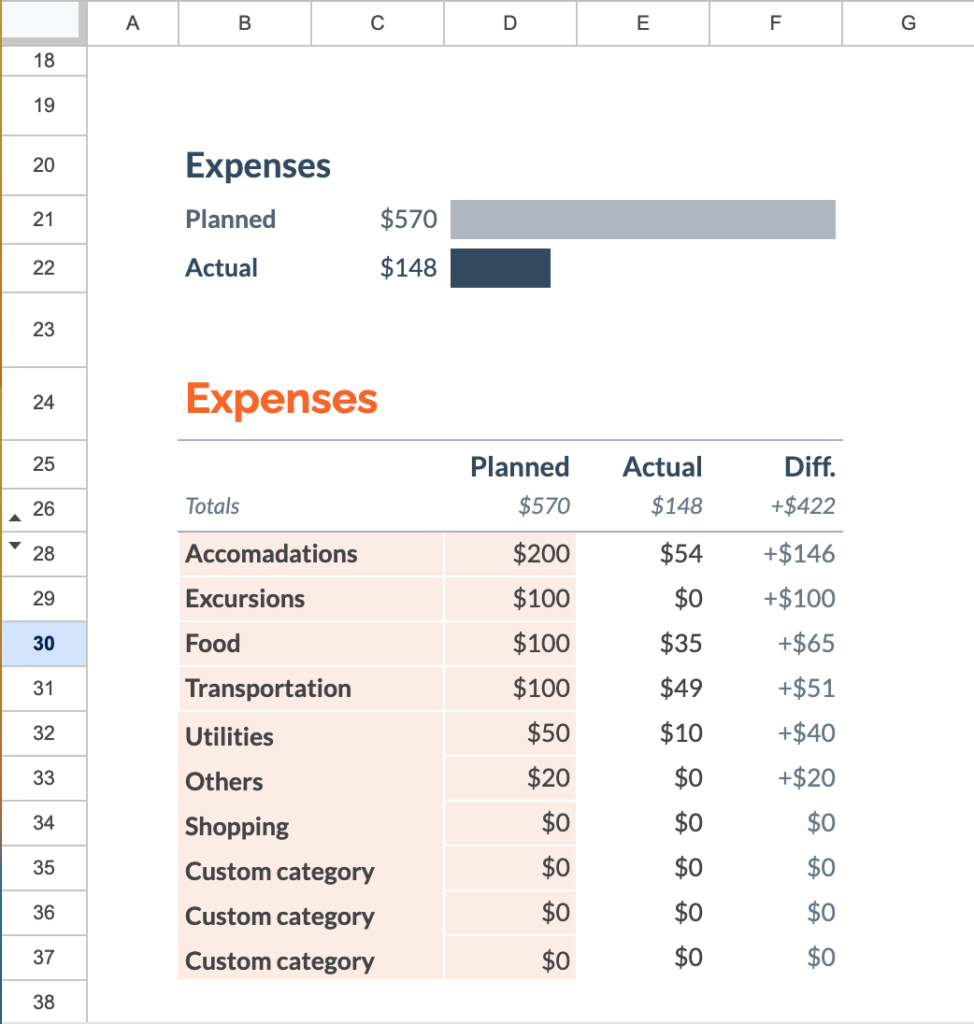

On Google Drive, they offer a template for budgeting (link below). This is what I use to track my total expenses. Again, I split it up to each country I visited to make things easier for myself and type the date purchased, cost, description and what category it fit into. This technique helps me see clearly how much I am spending on average on food, transportation, accommodations etc, and if I need to make changes later on in my trip.

The only disadvantage I found with this method is getting into the habit of typing each purchase was a challenge to start and constantly keeping expenses at the forefront of my mind can hinder the enjoyment of my travels. Though as more time went by I found being aware of my expenses created less stress than being blinded by my purchases.

It’s easy to get too excited and lose track of where your money is going on your travels but can make the world of a difference if you are tracking expenses. In most cases, I would catch myself spending more than I intended on purchases I didn’t need meaning I would have to be more frugal later on. Keeping track and budgeting my travel expenses saved me a lot of stress and time attempting to organize my expenses later on. Also, I understand this method may be too time consuming and there are other apps specifically made for tracking expenses which may work as a better option for you. Though I have not tried these apps, here is a blog that talks about 8 Apps that will help track travel expenses by The Points Guy, if you are looking for more information on which method may work best for you.

It’s important to note that traveling will be different for everyone, and because I was backpacking for a long period of time, I had to be very frugal with expenses. Though looking back I do wish I spent the extra money trying different excursions (like skydiving in Australia), it’s important to keep a balance between spending and saving. If taking a vacation is a rare treat then you may choose to spend without a budget, it is crucial to find a method that fits your own travel needs, ensuring a vacation that will be exciting, relaxing, or super adventurous.